As you near retirement, becomes crucial to assess your financial well-being. A traditional IRA may not always offer the amount of safety you desire in today's {economy|. The possibility for inflation can reduce the worth of your funds over time. This is where a Gold IRA enters as a compelling asset to balance your portfolio and protect your hard-earned funds.

- Invest in physical gold, a reliable hedge of value.

- Protect your portfolio from inflation.

- Hedge risk by including a tangible investment in your retirement plan.

A Gold IRA can offer several benefits for retirees and people planning for their {future|. Consult a retirement specialist today to learn more about how a Gold IRA can assist you protect your retirement.

Tapping Into Wealth Potential: The Gold IRA Advantage

In today's volatile economic landscape, savvy investors strive alternative avenues to secure their hard-earned wealth. A Gold Individual Retirement Account (IRA) presents a compelling solution, offering a powerful opportunity to diversify your portfolio and reduce risk.

Gold has historically served as a robust store of value, surviving inflation and economic downturns. By investing in a Gold IRA, you can harness the inherent stability of gold while enjoying the tax advantages of a traditional retirement account.

- Advantages of a Gold IRA include:

- Diversification: Adding physical gold to your portfolio can balance the risks associated with traditional investments.

- Inflation Hedge: Gold has a proven track record of holding its value during inflationary periods.

- Deductible Contributions: Gold IRAs offer similar tax benefits to other retirement accounts, allowing you to minimize your tax liability.

Consult with a qualified financial advisor to explore whether a Gold IRA is the right investment for your retirement plan.

Securing Your Future

As you approach retirement, growing your portfolio becomes critically important. Explore adding precious metals like gold and silver to your retirement strategy. These assets have a track record of preserving value during market uncertainty, making them a viable hedge against inflation.

- Speak with a financial advisor to understand the right allocation of precious metals for your individual needs.

- Explore different methods of investing in precious metals, such as mining stocks.

- Spread your investments across various asset classes to minimize risk.

Remember, retirement planning is a ongoing process. Continuously review and modify your portfolio as your situation change.

Enhance Your Wealth with a Gold IRA

A well-structured portfolio should always feature diversification. By spreading your assets across various sectors, you mitigate risk and potentially enhance returns. One compelling option to consider is a Gold IRA, permitting you to invest in physical gold while enjoying the tax perks of an Individual Retirement Account. Gold has historically served as a hedge against inflation, making it a valuable element to any diversified portfolio.

- Speak with a financial consultant to evaluate if a Gold IRA is right for your investment objectives

- Comprehend the charges associated with opening and holding a Gold IRA.

- Investigate different providers that offer Gold IRA products.

Remember, diversifying your portfolio is a continuous process. Regularly evaluate your investments and make changes as needed to align they remain in line with your financial goals.

Constructing a Resilient Nest Egg: The Gold IRA Path

In today's shifting economic landscape, safeguarding your financial future is paramount. A traditional investment plan may not be enough to weather the storms of inflation and market fluctuations. That's where a Gold IRA steps in as a potent tool for building a resilient nest egg. By diversifying your portfolio with physical gold, you can reduce risk and preserve the purchasing power of your savings over the long term.

A Gold IRA offers a number of benefits. To begin with, gold has historically served as a safe haven during times of economic turmoil. Furthermore, gold is not subject to the comparable market volatility as stocks or bonds, providing a degree of stability that traditional investments fail to offer.

- In addition, Gold IRAs allow you to build up physical gold over time, which can be converted into cash if needed.

Consequently, a Gold IRA presents a compelling path to building a resilient nest read more egg that can withstand the ups and downs of the financial world.

Top Guide to Gold IRA Investments

Looking to safeguard your future? A Gold IRA might be the perfect option for you. This comprehensive guide will walk you through the fundamentals of Gold IRAs, helping you make smart investment decisions. From grasping the advantages to reviewing the steps, we've got you equipped.

Gold IRAs offer a unique opportunity to broadened your portfolio with valuable commodities. By putting money in physical gold, you can potentially hedge against economic uncertainty.

- Let's|what you need to know about Gold IRAs:

- Variations of Gold IRA Accounts

- Selecting a Reputable Custodian

- Acquisition Tactics for Gold IRAs

- Tax Implications of Gold IRA Investments

Don't miss out on the potential to grow your retirement savings with a Gold IRA. Start learning about this powerful investment approach today!

Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Danica McKellar Then & Now!

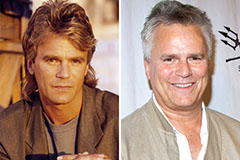

Danica McKellar Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!